Future Value and Annuity Formulas

Future Value (FV) is one of the most important concepts in finance and investing. It tells us how much an investment made today will be worth at a future date, considering interest, compounding, and additional payments such as annuities.

What is the Future Value Formula?

The Future Value Formula calculates the value of money at a future time, given an interest rate and compounding over periods. In simple terms, it answers:

“If I invest money today, how much will it be worth later?”

- FV = Future Value

- PV = Present Value

- PMT = Payment Amount per period (annuity payments)

- i = Interest rate per period (decimal form)

- n = Number of periods (when compounding matches payment periods)

- m = Compounding frequency per period (monthly, quarterly, etc.)

- t = Total number of years (when compounding is more frequent than payments)

- g = Growth rate of payments per period

- T = Annuity Type (T = 0 for Ordinary Annuity, T = 1 for Annuity Due)

- e = Euler’s number (≈ 2.71828), used for continuous compounding

Future Value Formulas

Here’s a complete breakdown of Future Value and Annuity formulas in plain text for SEO and simplicity:

| Type | Formula (Plain Text) |

|---|---|

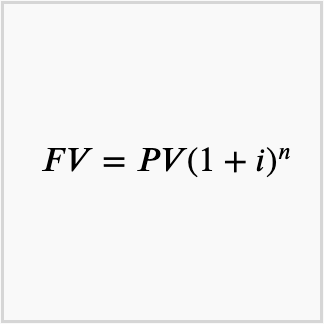

| 1. Future Value of a Present Sum | FV = PV × (1 + i)^n |

| 2. Future Value of an Annuity | |

| 2.1 Ordinary Annuity (T = 0) | FV = PMT × [(1 + i)^n – 1] / i |

| 2.2 Annuity Due (T = 1) | FV = PMT × [(1 + i)^n – 1] / i × (1 + i) |

| 3. Future Value of a Growing Annuity (g ≠ i) | |

| Ordinary Annuity (T = 0) | FV = PMT × [(1 + i)^n – (1 + g)^n] / (i – g) |

| Annuity Due (T = 1) | FV = PMT × [(1 + i)^n – (1 + g)^n] / (i – g) × (1 + i) |

| 4. Future Value of a Growing Annuity (g = i) | |

| Ordinary Annuity (T = 0) | FV = PMT × n × (1 + i)^(n – 1) |

| Annuity Due (T = 1) | FV = PMT × n × (1 + i)^n |

| 5. Future Value for Combined Future Value Sum and Cash Flow Annuity | |

| 5.1 With Ordinary Annuity (T = 0) | FV = PV × (1 + i)^n + PMT × [(1 + i)^n – 1] / i |

| 5.2 With Annuity Due (T = 1) | FV = PV × (1 + i)^n + PMT × [(1 + i)^n – 1] / i × (1 + i) |

| 6. Future Value for Combined Sum with Growing Annuity (g < i) | FV = PV × (1 + i)^n + PMT × [(1 + i)^n – (1 + g)^n] / (i – g) |

| 7. Future Value for Combined Sum with Growing Annuity (g = i) | FV = PV × (1 + i)^n + PMT × n × (1 + i)^(n – 1) |

| 8. Future Value with Compounding, Time, and Rate | FV = PV × (1 + (r/m))^(m × t) |

| 9. Future Value with Continuous Compounding (m → ∞) | FV = PV × e^(r × t) |

| 9.1 With Ordinary Annuity (T = 0) | FV = PV × e^(r × t) + PMT × [(e^(r × t) – 1) / (e^r – 1)] |

| 9.2 With Annuity Due (T = 1) | FV = PV × e^(r × t) + PMT × [(e^(r × t) – 1) / (e^r – 1)] × e^r |

| 10. Future Value of a Growing Annuity (g ≠ i) with Continuous Compounding | FV = PMT × [(e^(i × n) – e^(g × n)) / (i – g)] |

| 11. Future Value of a Growing Annuity (g = i) with Continuous Compounding | FV = PMT × n × e^(i × (n – 1)) |

Practical Examples of Future Value

Example 1: Simple Future Value of Present Sum

If you invest $1,000 at 5% annual interest for 10 years:

FV = 1000 × (1 + 0.05)^10 = $1,628.89

Example 2: Future Value of an Ordinary Annuity

You deposit $200 at the end of each year for 10 years at 6%:

FV = 200 × [(1 + 0.06)^10 – 1] / 0.06 = $2,637.97

Example 3: Future Value of an Annuity Due

If the same $200 deposit happens at the beginning of each year:

FV = 200 × [(1 + 0.06)^10 – 1] / 0.06 × (1 + 0.06) = $2,796.26

Why Future Value Matters

- Investment planning: Understand how savings grow.

- Retirement planning: Calculate annuities and pension plans.

- Corporate finance: Evaluate cash flows and project returns.

- Personal finance: Compare loan repayments vs. investments.

The Future Value Formula is the foundation of time value of money (TVM). Mastering it gives you clarity in making smarter financial decisions.

Cite this content, page or calculator as:

Ahmed Zaheer “Future Value Formula” at https://calculatorcave.com/calculators/financial/future-value-formula/ from CalculatorCave, https://calculatorcave.com – Online Calculators