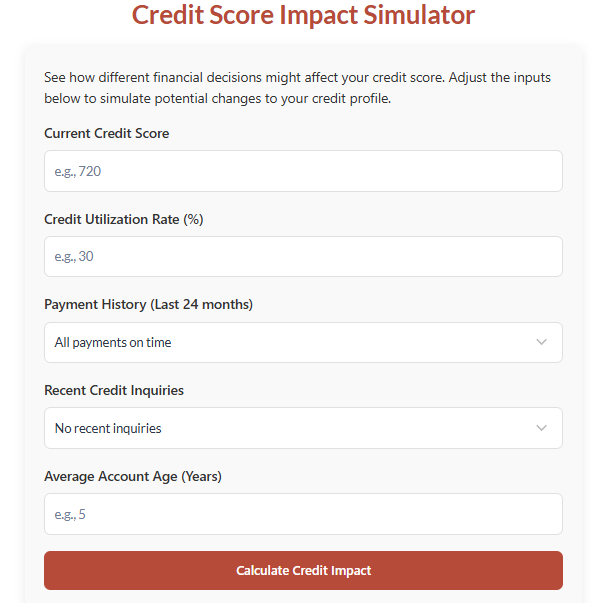

Credit Score Impact Simulator

See how different financial decisions might affect your credit score. Adjust the inputs below to simulate potential changes to your credit profile.

Your Simulated Credit Score

Factors Affecting Your Score

Share This Calculation

Cite this content, page or calculator as:

Appreciate our scientific content creators and cite this page. Your support matters and keeps us motivated!

Credit Score Simulator

A credit score simulator is an interactive tool that predicts how certain financial decisions might impact your credit score. Whether you’re planning to pay down debt, open a new credit card, or take out a loan, a credit score simulator helps you estimate how your score could change before you take action.

By modeling your potential financial moves, you can make smarter credit choices and improve your overall financial health.

How a Credit Score Simulator Works

A credit score simulator uses algorithms and credit data to estimate how various financial behaviors influence your credit score. Think of it as a “what-if” machine for your credit life — it allows you to experiment with hypothetical actions and see potential outcomes instantly.

There are generally two main types of credit score simulators:

1. Questionnaire-Based Simulators

These tools ask you a series of questions about your credit history and habits. For example:

- How many credit cards and loans you currently have

- How long you’ve had them

- Your repayment history

Once you provide your answers, the simulator estimates your credit score range. The FICO® Scores Estimator is a well-known example of this type.

2. Real-Time Data Simulators

Some simulators are linked to your actual credit report. They analyze your current FICO® or VantageScore® and simulate how it might change under various financial scenarios.

For example, the Experian FICO® Score Simulator can show how your score could shift if you:

- Apply for a new credit card

- Miss a bill payment

- Pay off your balances

- Close one or more accounts

- Max out your available credit

- File for bankruptcy

Each scenario produces a projected range showing how your score may rise or fall.

How Your Credit Score Is Calculated

Before exploring simulations, it’s crucial to understand the core components of a credit score. Most scoring models, including the FICO® Score, weigh these five factors:

| Factor | Description | Weight in FICO® Score |

|---|---|---|

| Payment History | Tracks on-time and late payments. Missing even one payment can drop your score significantly. | 35% |

| Amounts Owed | Measures how much credit you use versus your total available credit (credit utilization). | 30% |

| Length of Credit History | Considers the age of your oldest and newest accounts and the average age of all accounts. | 15% |

| Credit Mix | Rewards having a balance of credit types (credit cards, auto loans, mortgages, etc.). | 10% |

| New Credit | Reflects recent credit inquiries and newly opened accounts. Too many at once can lower your score. | 10% |

Understanding these factors helps you interpret what your simulator results mean — and where you can improve.

Why Credit Scores Differ Across Simulators

You might notice your score varies depending on the credit score simulator or service you use. Here’s why:

- Different Scoring Models:

There are multiple versions of the FICO® Score and VantageScore®, each with slightly different algorithms. Even when based on identical credit report data, two models can generate different scores. - Data Timing:

Credit reports are updated frequently. Your balances, inquiries, and payments can change from week to week, meaning simulators that use different report dates may produce different results. - Credit Bureau Variations:

Each major credit bureau — Experian, TransUnion, and Equifax — maintains its own version of your credit report. Lenders may report to one, two, or all three, so your data might not be consistent across them.

Even though credit score simulators can’t predict exact lender results, they’re still powerful for understanding trends and improving financial behavior.

What Credit Score Simulators Can and Can’t Do

A credit score simulator is not a crystal ball — it’s a predictive model. Here’s what you can realistically expect:

What They Can Do

- Estimate the impact of single actions like paying off a card or missing a payment.

- Show positive or negative trends — whether your score will likely rise or fall.

- Educate you about which financial behaviors are most beneficial for your credit.

What They Can’t Do

- Model multiple simultaneous changes accurately. For instance, taking out a new loan and increasing your credit card balance might affect your score more than either action alone.

- Account for all credit activity across different lenders and accounts in real time.

- Guarantee precise results, since lenders use varying score models and report data at different times.

Treat your simulated score as a directional guide, not a definitive number.

When to Use a Credit Score Simulator

A credit score simulator is useful anytime you’re planning major financial decisions. Here are key scenarios where it can help:

1. Paying Down Debt Strategically

If you have several credit cards, simulators can help you decide which balances to pay off first to achieve the fastest credit score improvement.

2. Preparing for a Loan Application

Before applying for a mortgage, car loan, or personal loan, you can see how certain actions — like lowering your credit utilization or reducing inquiries — might improve your score.

3. Planning Ahead for Big Purchases

If you know your target score range for a future mortgage or auto loan, you can use a simulator to model actions that push you closer to that goal.

4. Recovering from Credit Damage

If you’ve missed payments or defaulted in the past, a simulator can estimate how long it may take to rebuild your credit under positive financial behavior.

Benefits of Using a Credit Score Simulator

Using a simulator offers several tangible benefits:

- Risk-Free Experimentation: You can test out decisions before they affect your real credit score.

- Educational Insight: Learn how small financial habits (like keeping balances under 10% utilization) can lead to higher scores.

- Goal Tracking: See your progress over time as you improve your score through responsible credit management.

- Confidence in Decisions: Make informed choices when applying for credit, paying debt, or closing accounts.

Limitations to Keep in Mind

Even the most accurate simulators can’t predict everything. Real-world results depend on:

- The specific credit model a lender uses

- How quickly your lenders update their data

- Any new credit events not yet reflected in your report

That said, simulators remain excellent for learning and strategic planning, especially when combined with free tools like Experian or Credit Karma.

Smart Credit Starts With Understanding

A credit score simulator doesn’t just estimate your score — it helps you understand the relationship between your actions and your financial future. By consistently paying on time, keeping balances low, and avoiding unnecessary credit inquiries, you can steadily improve your creditworthiness.

If you want to see how your choices today might shape your financial tomorrow, try using a credit score simulator before making your next big move. Small changes now can add up to major improvements in your credit score over time.